Introduction

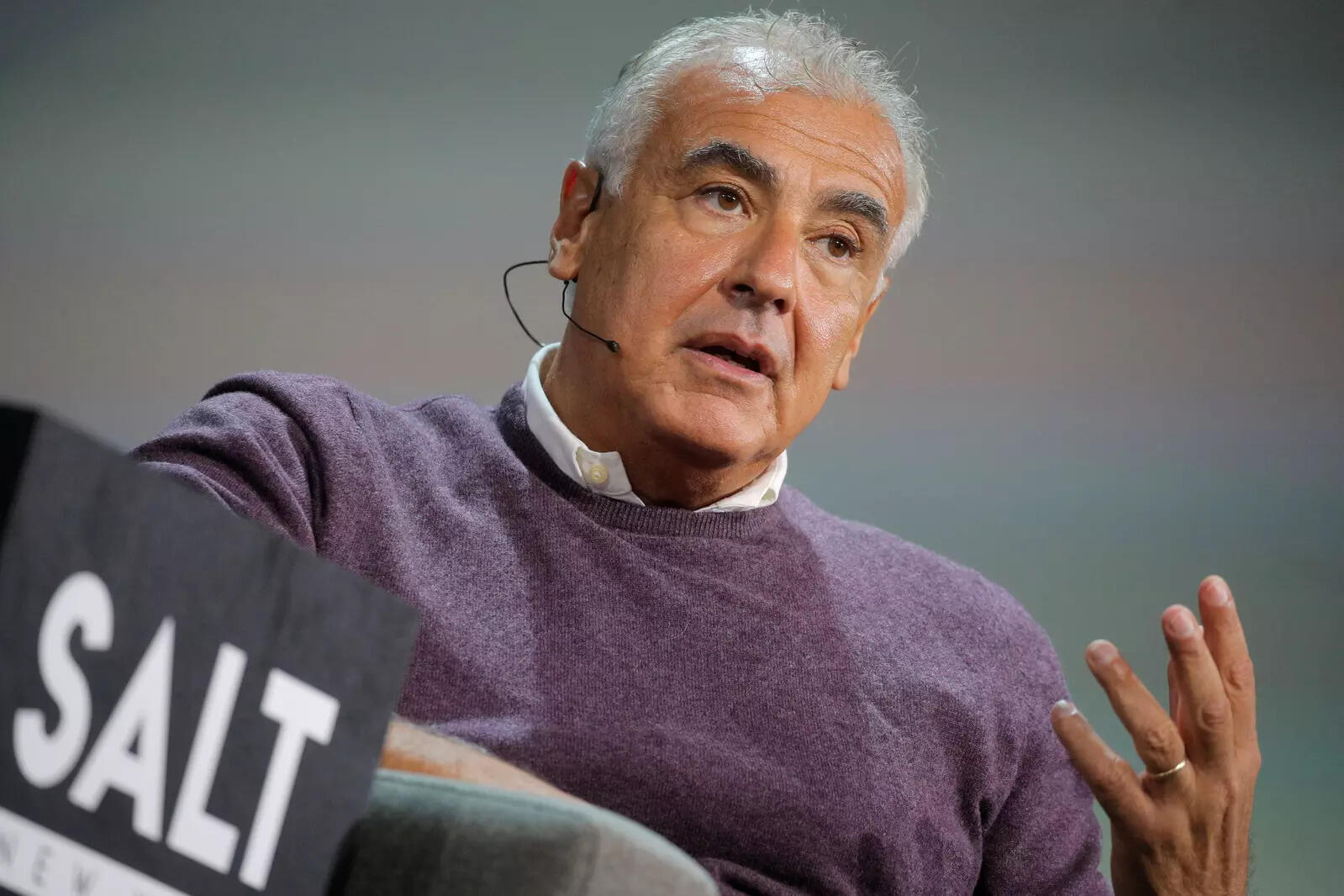

In the world of finance, few names resonate as strongly as Marc Lasry. As the co-founder of Avenue Capital Group, Lasry has carved out a considerable specific niche for himself in the realm of wealth management and investment. His journey from humble starts to becoming a prominent figure on Wall Street is not simply motivating however likewise illustrative of the moving paradigms within investment strategies and asset management. This short article looks into From Wall Street to Wealth Management: The Increase of Marc Lasry and Avenue Capital, checking out the aspects that added to his success, the strategies utilized by Avenue Capital, and what aiming investors can gain from his experiences.

The Early Years: A Prelude to Success

Marc Lasry's Background

Marc Lasry was born in 1960 in Marrakech, Morocco, before relocating to New York City at a young age. Growing up in a modest family, his parents immigrated to America looking for much better chances. This background instilled in him a strong work ethic and a gratitude for education.

Education and Early Career Choices

Lasry participated in Clark University, where he made his degree in government. After completing his education, he embarked on a profession that would ultimately lead him to Wall Street. He started his professional journey at the financial investment firm Drexel Burnham Lambert, where he honed his skills in high-yield bond trading.

Wall Street Experience: Building Foundations

Early Days at Drexel Burnham Lambert

At Drexel Burnham Lambert, Lasry learned the intricacies of high-stakes trading and monetary markets. His understanding of distressed assets and their capacity for recovery would later play an important function in shaping Avenue Capital's financial investment philosophy.

Transitioning to Wealth Management

After a number of years on Wall Street, Lasry acknowledged that there was a chance to build something higher-- something that might serve clients looking for wise financial investment options. This realization led him towards wealth management.

The Birth of Avenue Capital

Founding Avenue Capital Group

In 1995, Marc Lasry established Avenue Capital Group along with business partner Sonia Gardner. With an initial concentrate on distressed financial obligation investing, Avenue Capital aimed to supply innovative solutions for financiers seeking high returns throughout financial downturns.

Strategic Vision and Philosophy

Avenue Capital's tactical vision was rooted in determining underestimated assets with substantial upside capacity. This approach permitted them to thrive even throughout financial crises when other companies faltered.

Investment Strategies: The Avenue Capital Way

Distressed Financial obligation Investing Explained

One key aspect of Avenue Capital's technique is distressed financial obligation investing. But what does this mean? Essentially, it involves buying bonds or debt instruments provided by companies facing financial difficulties at reduced prices.

Benefits of Distressed Financial obligation Investing

High Prospective Returns: If a business recovers, investors can see significant gains. Diversification: Distressed financial obligation can offer diversification advantages within an investment portfolio. Market Inefficiencies: Lots of investors neglect distressed possessions due to perceived risks.The Function of Research study and Analysis

At Avenue Capital, thorough research is vital. The company's experts use robust methodologies for assessing possible financial investments-- detailed market analyses coupled with macroeconomic assessments are basic practices that set them apart from competitors.

Key Turning points in Avenue Capital's Journey

Early Success Stories

In its early years, Avenue Capital garnered attention for its impressive performance during monetary recessions such as the dot-com bubble burst around 2000.

Case Study: Innovation Sector Recovery

Lasry's team invested heavily in tech companies throughout their low points post-bubble rupturing, resulting in significant profits when these business rebounded.

Navigating Financial Crises

The 2008 monetary crisis postured distinct obstacles; however, it also provided chances for smart financiers like Lasry. By profiting from distressed properties during this period, Avenue Capital solidified its track record as a resistant player in wealth management.

Marc Lasry's Management Style and Philosophy

Visionary Leadership Qualities

Lasry's leadership style is often referred to as inclusive and forward-thinking. He promotes an environment where imagination can thrive among his staff member while motivating open discussion about investment strategies.

Commitment to Customer Relationships

Another hallmark of Lasry's leadership is his commitment to building strong client relationships-- he believes trust is essential in wealth management.

Avenue Capital's International Reach and Expansion

International Investments: A Broader Perspective

With head office in New york city City however offices throughout Europe and Asia, Avenue Capital has actually expanded its reach beyond American borders-- investing internationally allows them access to diverse markets and opportunities.

Regional Focus Areas

- North America Europe Asia Pacific

Adapting Investment Techniques Across Borders

Different regions present distinct obstacles; therefore, adjusting their strategies accordingly has been vital for continued success outside domestic markets.

Technological Innovations Affecting Wealth Management

The Role of Fintech Solutions at Avenue Capital

As technology continues progressing rapidly within finance sectors worldwide-- consisting of wealth management-- Avenue Capital accepts fintech developments that enhance decision-making processes through information analytics tools or AI-driven algorithms created specifically for financial investments analysis purposes.

Examples Include:

Algorithm-based trading platforms. Advanced predictive analytics tools. Blockchain technology applications for transparency.Challenges Dealt with by Marc Lasry and Avenue Capital

Competitive Landscape within Wealth Management Sector

The world of wealth management is fiercely competitive-- numerous large companies contend for clients through aggressive marketing projects or innovative product offerings developed explicitly targeting high-net-worth individuals (HNWIs).

Regulatory Obstacles Impacting Investment Strategies

Changes in policies can pose challenges; browsing these complexities requires diligence-- a skill set cultivated over years spent running successfully in the middle of altering market characteristics while staying compliant with regional laws governing finance-related activities internationally too!

FAQs About Marc Lasry & & Opportunity Capital

1. Who is Marc Lasry?

Marc Lasry is an accomplished investor known for co-founding Avenue Capital Group-- a firm specializing primarily in distressed financial obligation financial investments customized towards wealth management services aimed at HNWIs globally!

2. What is Avenue Capital?

Avenue Capital Group focuses on alternative financial investments across numerous property classes (including equities) specializing particularly focusing locations such as private credit & & real estate endeavors worldwide!

3. How did Marc Lasry get started?

Lasry started his profession at Drexel Burnham Lambert after finishing from Clark University before founding his firm along with Sonia Gardner back into '95 paving way towards producing avenues offering ingenious options serving customers effectively!

4. What are some successful financial investments made by Opportunity capital?

Some significant Avenue Capital insights successes include investments made throughout both financial downturns; they capitalized heavily upon tech stocks after bubbles rupture leading substantial revenues when recoveries happened allowing them continue growing amidst challenges faced throughout periods!

5 What does distressed debt investing entail?

Distressed financial obligation investing involves buying undervalued bonds released by economically distressed companies preparing for potential recoveries resulting remarkable revenue increases afterwards if successful!

6 Is technology affecting wealth management considerably today?

Absolutely! Technological improvements have actually reinvented how companies operate-- from enhanced analytics platforms improving decision-making processes down making use of blockchain making sure openness-- all essential aspects driving modern-day effectiveness accomplished within market landscape overall!

Conclusion

In conclusion, the story encapsulated through "From Wall Street to Wealth Management: The Rise of Marc Lasry and Avenue Capital" showcases not only individual strength but likewise systemic versatility needed prospering effectively in the middle of ever-changing landscapes characterizing today's global finance markets! As we evaluate how both personal experiences shaped choices brought this journey-- it becomes clear significance lies less solely within financial gains achieved but rather much deeper values associated preserving integrity relationships built promoting lasting collaborations yielding positive results throughout future undertakings pursued ahead!